The tax lien process begins in the spring following the tax year. To release a tax lien, this fee must be paid, along with the taxes (plus penalty and interest already accrued) at the Finance Department in City Hall. If we do file a lien on your property, it will cost an additional $146 fee. However, a Lien on your property may be filed with the Clark County clerk for unpaid tax bills. The City of Winchester does not sell delinquent property tax bills. You can lookup your county tax bill at Clark County Sheriff’s Department. You may contact the Sheriff’s Office at (859) 744-4390. You can pay your county tax bill at the Sheriff’s Office which is located at 17 Cleveland Avenue in Winchester. Find Property Records, including: Nevada property titles and deeds.

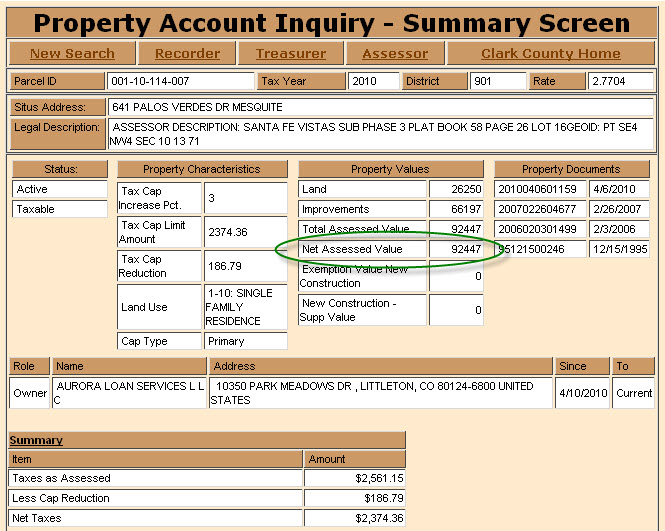

If you live in the city or your business is located in the city, you will receive a city tax bill and a county tax bill. Several government offices in NV state maintain Property Records, which are a valuable tool for understanding the history of a property, finding property owner information, and evaluating a property as a buyer or seller. The City of Winchester currently accepts the following forms of payment: Once the property is found and selected, the current market value and the new proposed. You may also pay your bill in person at the Finance Department office or drop your payment in the drop box in front of City Hall, View a map of City Hall. A property search may be done by owner name, address, or parcel number. Please include a self-addressed stamped envelope if you would like a receipt. You may pay your tax bill by mail by sending your payment, along with the bottom portion of your bill to the City of Winchester’s Finance Department. If you need to change your mailing address or have a question about your assessment, please contact the Property Valuation Administrator (PVA) Office at (859) 745-0250. If you have purchased property since January 1st, please do not assume that the seller will pay the taxes. Property tax bills are mailed to the owner of the record as of January 1st of the current tax year. If your taxes are escrowed, please forward your bill to your mortgage company. You can search by address, name, or map number.

You may lookup your tax bill at Property Tax Lookup. At this time we can not accept payments over the phone or online.Īfter December 4th, a 10% penalty is assessed. These is an additional $5.00 charge for using debit or credit card. We accept cash, check, money order or credit card. These bills are due each year on the first Friday in December making this year's bill due December 3rd. The bill does say up in the left hand corner City of Winchester so that you can distinguish between the City and County. Your bill will look very similar to the County bills since they are coming out in a sealed mailer instead of an envelope. You will notice a difference in our bills this year. The 2021 City Property Tax bills will be mailed out the week of October 25, 2021.

0 kommentar(er)

0 kommentar(er)